Things about Medigap Benefits

The Facts About What Is Medigap Uncovered

Table of ContentsThe Medigap DiariesOur Medigap StatementsSome Known Details About What Is Medigap See This Report about MedigapThe 9-Second Trick For Medigap BenefitsGet This Report about What Is Medigap

A (Lock A locked padlock) or indicates you've safely connected to the. gov site. Share delicate info only on official, safe websites.What actually stunned them was the realization that Medicare would certainly not cover all their healthcare costs in retired life, consisting of those when taking a trip abroad. "We take a trip a great deal and also want the security of knowing we can get clinical treatment far from residence," states Jeff, who with Alison is expecting seeing her family members in England.

"Also elite professional athletes run right into health issue as they move through the years." "Speak to your medical professional regarding aging and also take a look at your household history," states Feinschreiber. "Maybe a good overview to help determine the type of coverage you might want to plan for." Considering that there is no "joint" or "family members" insurance coverage under Medicare, it might be much more affordable for you and your spouse to choose different insurance coverage options from different insurance policy companies.

Getting My What Is Medigap To Work

The Ottos understand that their needs may transform over time, particularly as they cut itinerary as they grow older. "Although we have actually seen expenses enhance over the last 2 years considering that we signed up in Medigap, we have the right level of additional insurance coverage in the meantime as well as assume we're getting great worth at $800+ monthly for the both people consisting of dental insurance coverage," claimed Alison.

For residents in choose states, register in the appropriate Medicare prepare for you with aid from Integrity Medicare Providers.

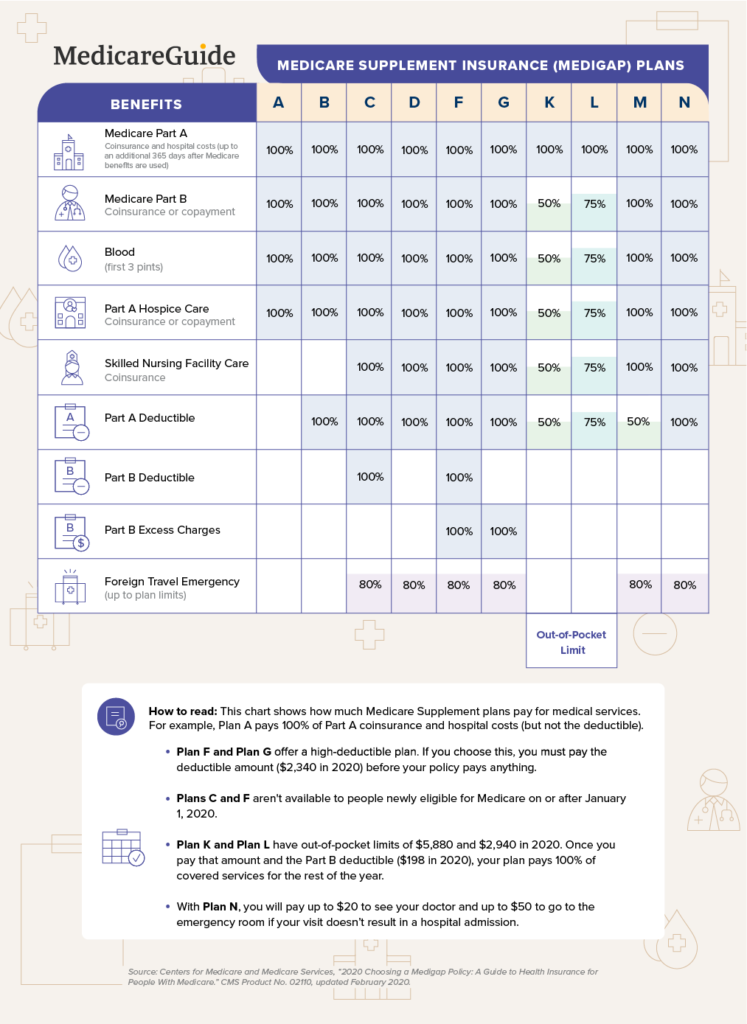

Not every plan will certainly be available in every state. Medicare Supplement Insurance is sold by exclusive insurer, so the price of a plan can vary in between one provider or area as well as another. There are a couple of various other points that might influence the cost of a Medigap strategy: The quantity of protection supplied by the strategy Whether or not medical underwriting is used as part of the application process The age at which you sign up with the strategy Qualification for any discount rates supplied by the service provider Sex (females often pay much less for a plan than guys) In order to be qualified for a Medicare Supplement Insurance coverage strategy, you should go to the very least 65 years of ages, registered in Medicare Part An and also Part B and also stay in the area that is serviced by the plan.

Unknown Facts About What Is Medigap

You are signed up in a Medicare Benefit or Medigap plan supplied by a company that misled you or was found to have actually not complied with specific governing policies. Medicare Supplement plans and Medicare Benefit intends job very in a different way, as well as you can not have both at the very same time. Medicare Supplement prepares job alongside your Initial Medicare insurance coverage to help cover out-of-pocket Medicare prices like deductibles as well as coinsurance.

Many strategies likewise offer various other advantages such as prescription medicine coverage or oral treatment, which Original Medicare doesn't commonly cover. Medicare Supplement strategy costs can vary based on where you live, the insurance policy companies supplying plans, the pricing structure those companies utilize and also the sort of strategy you use for.

The average regular monthly costs for the same plan in Iowa in 2022 was just $120 per month. 1 With 10 websites different sorts of helpful resources standard Medigap strategies as well as a range of advantages they can offer (and also the series of monthly premiums for each strategy), it can be helpful to make the effort to contrast the Medigap choices offered where you live - What is Medigap.

Examine This Report on What Is Medigap

You ought to take into consideration switching Medigap plans during specific times of the year, nevertheless. Transforming Medicare Supplement plans during the ideal time can aid secure you from needing to pay higher costs or being refuted insurance coverage due to your health or pre-existing conditions. There are a number of various Medicare Supplement Insurance provider throughout the nation.

You can discover more regarding them by contrasting company scores and also reviewing client testimonials. Medigap Strategy F covers more out-of-pocket Medicare prices than any other standardized kind of Medigap plan. For their month-to-month premium, Strategy F recipients understand that all of their Medicare deductibles, coinsurance, copays and various other out-of-pocket prices will be covered.

com that teach Medicare beneficiaries the best practices for browsing Medicare (medigap). His short articles read by countless older Americans monthly. By far better comprehending their health and wellness care coverage, visitors may ideally discover how to limit their out-of-pocket Medicare costs and gain access to quality healthcare. Christian's passion for his function originates from his wish to make a distinction in the senior community.

What Does How Does Medigap Works Do?

Throughout that time framework, insurer are usually not allowed to ask you any kind of wellness inquiries (additionally referred to as clinical underwriting). After that, you may have to answer those questions, as well as the solutions might result in a higher premium or to being decreased for Medigap coverage. A couple of exceptions exist.

Nevertheless, this is real just if they drop their Medicare Advantage coverage within 12 months of joining. Note: If you and your partner both purchase Medigap policies, some insurance coverage service providers will offer a house discount. That depends on the plan you choose. Medigap has 10 standardized insurance coverage plans that are related to letters of the alphabet: visit this site Strategies A, B, C, D, F, G, K, L, M as well as N.

However, within each plan, the advantages coincide due to the fact that they are standard. A Strategy A plan will have the same benefits no issue what insurance coverage company you acquire it from. So, the trick is to determine which strategy offers benefits that are most important to you. After that you can contrast offers from insurance company to insurance firm to find the most budget-friendly rate for the strategy you desire.